EV & Renewables

EV Charging

Industry News

News

Who's Who - Rolec: EV charging infrastructure installers can rely on

ROLEC has become one of the UK’s most established manufacturers of EV charging solutions, supporting installers while meeting the demands of today’s rapidly evolving market. ECN explores the company’s extensive capabilities and how installers and end users can benefit.

EV charging for today’s installations

Rising EV adoption, increasing power demands, and the need for scalable infrastructure create new challenges for both domestic and commercial installations.

ROLEC offers a comprehensive portfolio of AC fast and DC rapid charging solutions designed for a wide range of applications. Whether for residential driveways, workplace car parks, fleet depots, or destinations, ROLEC’s range is designed to outperform competitors in ease of installation, reliability, and flexibility for any project.

With products suited to single installations and multi-site rollouts, ROLEC supports you from start to finish, working across new builds, retrofits, and large-scale deployments.

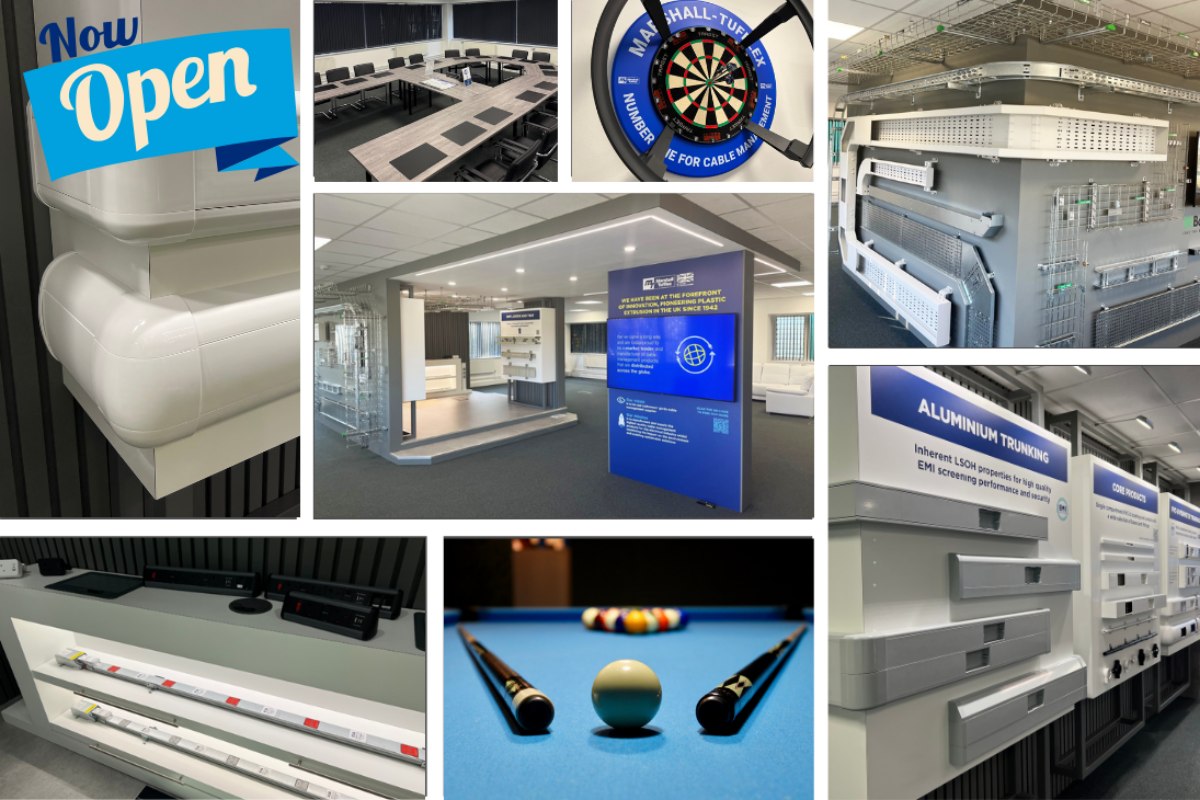

Expertise that educates

Central to ROLEC’S approach is knowledge transfer. By investing in the training of both current and future electrical contractors, ROLEC helps ensure best practice across the entire project lifecycle.

Purpose-built training academies, along with comprehensive free CPD-accredited courses, enable installation partners to deploy EV infrastructure efficiently and at scale. This commitment to collaboration and capability-building reflects ROLEC’s long-term view of industry growth – one built on competence, consistency, and confidence.

Design, compliance, and safety

Every ROLEC charger is designed and manufactured to meet relevant UK Government legislation and building regulations, giving installers complete confidence. Compliance and reliability are built into the hardware, with rigorous testing ensuring long-term performance in demanding environments.

Engineered using high-quality materials and robust enclosures suitable for outdoor, high-usage locations, ROLEC chargers deliver long-service operation for both installers and end users.

Installer-friendly features

By listening to installers on the ground, ROLEC shapes product development around real-world needs, ensuring chargers are practical for you to fit and maintain on site. With technical support, step-by-step documentation, and aftersales care, the company goes beyond being a supplier to become a long-term partner.

Features such as flexible cable entry points, clear internal layouts, robust mounting systems, and intuitive commissioning reduce installation time and complexity. Modular designs support efficient multi-charger setups, making ROLEC a trusted choice for larger projects where speed and precision matter.

These practical details may seem small, but together they help you work smarter, reduce call-backs, and deliver a premium finish each time.

True OCPP compliance

ROLEC recognises the growing need for scalability, connectivity, and adaptability. Its chargers come with true native OCPP as standard, designed to integrate with any software across more than 45 CPMS platforms, facilitating smooth onboarding to your customer's chosen provider.

Unlike many hardware solutions that rely on cloud-to-cloud connections, ROLEC chargers communicate directly with the platform, eliminating extra layers that can cause outages. This ensures faster, more reliable communication and reduces the risk of downtime for charging networks.

Loyalty rewards

At ROLEC, great work deserves recognition. The EVO Loyalty Incentive rewards installers for every 15 EVO chargers installed with a free EVO worth £449, making ROLEC not only the easiest to install but also the most rewarding for contractors in the UK market.

The scheme has been created to celebrate the rapid success of the EVO while rewarding the contractors behind it. Projects will be automatically tracked via the RolecConnect app during configuration, ensuring a seamless process, and ROLEC sends your free EVO straight to you.

With EVO, the benefits don’t stop at rewards. Work faster, powering through jobs with ease, you can install and configure units in under 10 minutes. This is a fantastic opportunity for ROLEC’s installer network to not only deliver the latest in EV charging technology but also be recognised for their ongoing work.

Powering the future together

ROLEC continues to place education and installer confidence at the centre of its growth strategy. With UK manufacturing expertise, a versatile product range, and a focus on practical installation needs, ROLEC is driving the next phase of EV infrastructure rollout, offering installers best in class.

From single home chargers to large-scale commercial and fleet installations, ROLEC delivers solutions that you can trust, operators rely on, and future networks require.

For more from ROLEC, click here.

Simon Rowley - 20 February 2026